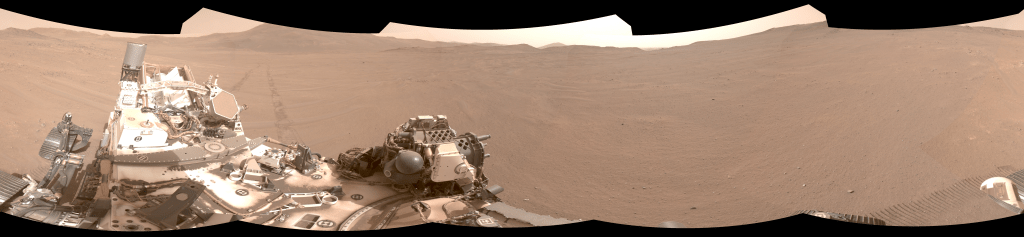

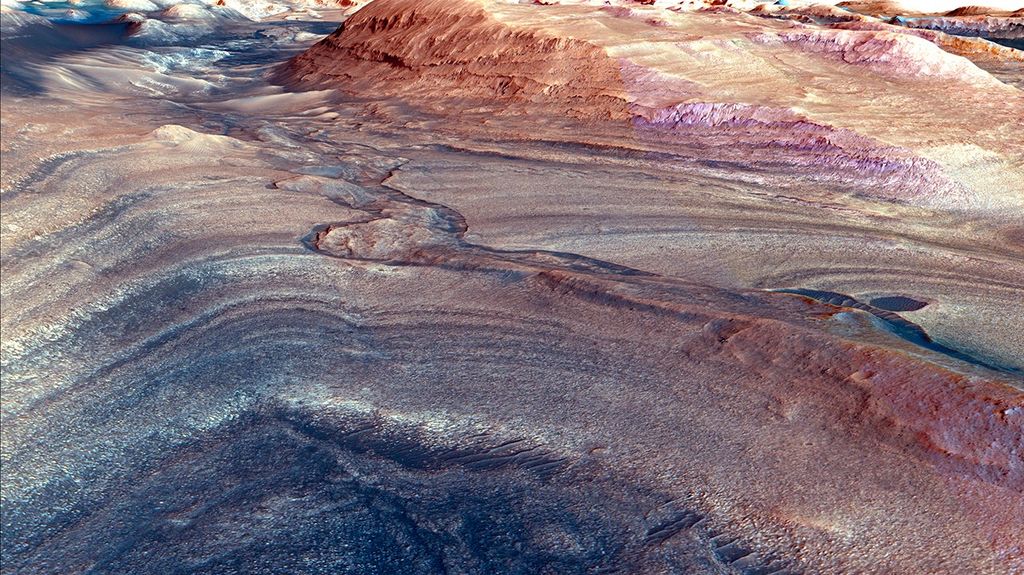

This report provides an extensive overview and assessment of the state-of-the-art (SoA) for small spacecraft technologies publicly available as of September 2024. The reader should be aware that the pace of SmallSat technology advancement overall is rapidly accelerating and varies per subsystem chapter. Technology maturation and miniaturization continues to expand small spacecraft capabilities with the rise in complex SmallSat mission designs. These improved capabilities have broadened the common SmallSat platform resulting in larger CubeSats and smaller SmallSats; the traditional CubeSat platforms of 1U and 3U volume now include up to 16U form factors. SmallSats once designed as <400 kg are now <100 kg with similar capability for less cost.

While still fairly dominated by the traditional CubeSat form factor, this SoA report is starting to reflect increased interest in the larger, more capable SmallSat platforms. This and the rise in SmallSat accessibility and improved state-of-the-art technology indicate the transition into the next-generation SmallSat paradigm. There has been a significant surge in launch opportunities and services for these larger, more capable SmallSat platforms such as rideshares, hosted payloads, and dedicated launchers. Between 2022 and 2024, there was particular focus on missions actively working on rideshares (or dedicated rides) to LEO destinations as stepping stone towards deep space presence and science data collection capabilities of SmallSats. Hosted payload services are also increasingly more availabile for larger SmallSats and other commercial satellites that can accommodate additional instrumentation or technologies for demonstration. Dedicated launches provide rapid integration and greater mission design flexibility, allowing spacecraft designers to better dictate mission parameters, and a wide variety of integration and deployment systems are now available to facilitate access to space for small spacecraft.

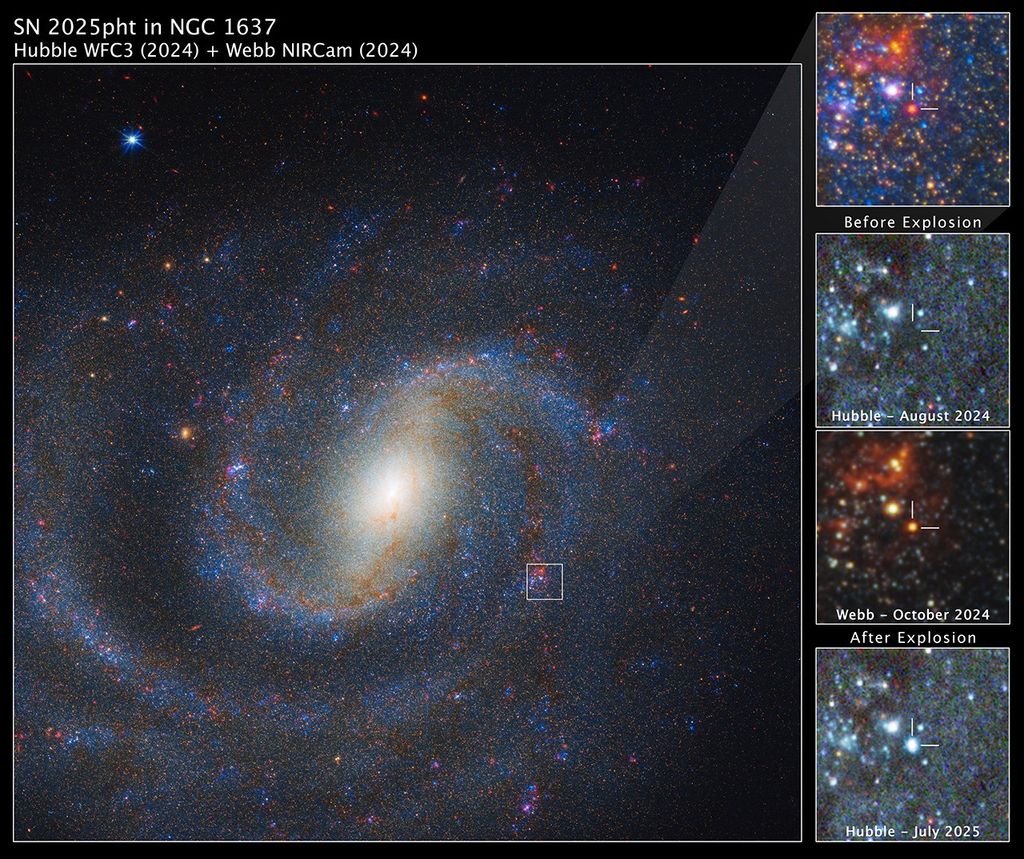

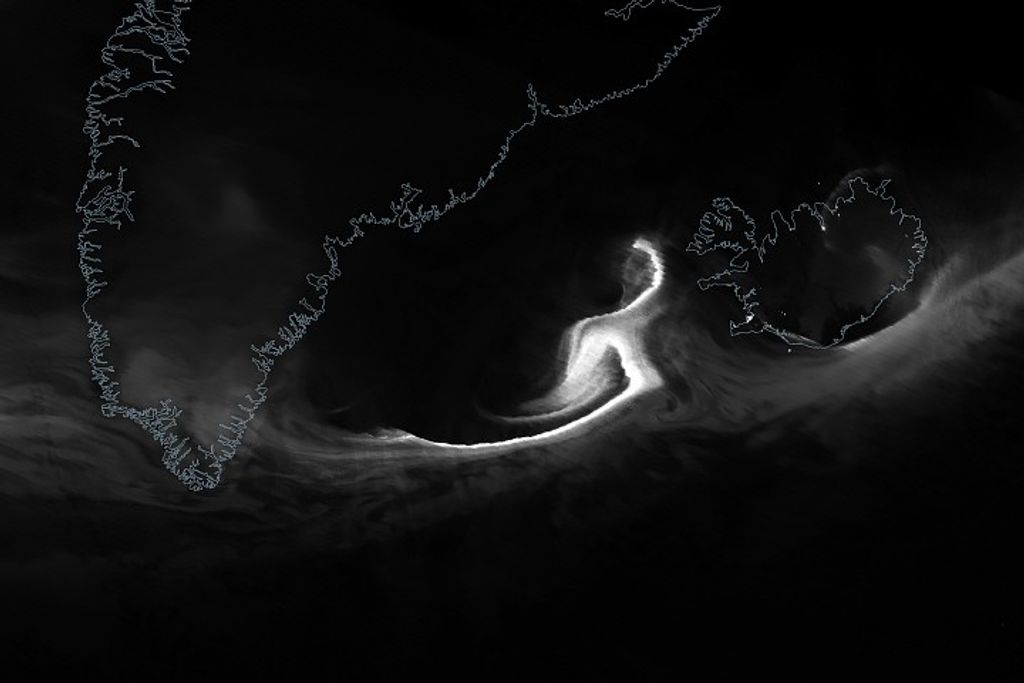

This SoA edition reports specific subsystem growth with recent flight demonstrations of innovative technologies on SmallSat missions, enhanced ground station support, improved technical efficiency, emerging sensor technology, and in rideshare and hosted payload opportunities. Recent SmallSat efforts have demonstrated enhanced technical capability which is the stepping stone needed for our deep space understanding and exploration. The successful flights of PTD-3 and CLICK have initiated optical communication technology on spacecraft and the surplus of optical ground station networks support this shift in data collection. In development for small spacecraft, LiDAR sensor technology has applications for improved altimetry and relative navigation that can be applicable for rendezvous, docking, and formation flying. The ongoing Solid-tate Architecture Batteries for Enhanced Rechargeability and Safety (SABERS) project at NASA GRC is paving the way for solid-state batteries with significantly higher energy than the current state-of-the-art lithium-ion batteries and with less hazardous qualities. In the past few years, there has been particular consideration on deployment mechanisms for multiple small spacecraft subsystems such as antenna booms, gravity gradient, stabilization, sensors, sails, and solar panels, and these technologies are gaining space heritage through operations. New deployable structures and solar sail technologies on the ACS3 mission are on-orbit currently for characterization. There is a spike in position, navigation, and timing technology progression in inertial sensors and atomic clocks, and magnetic navigation for near-Earth environments.

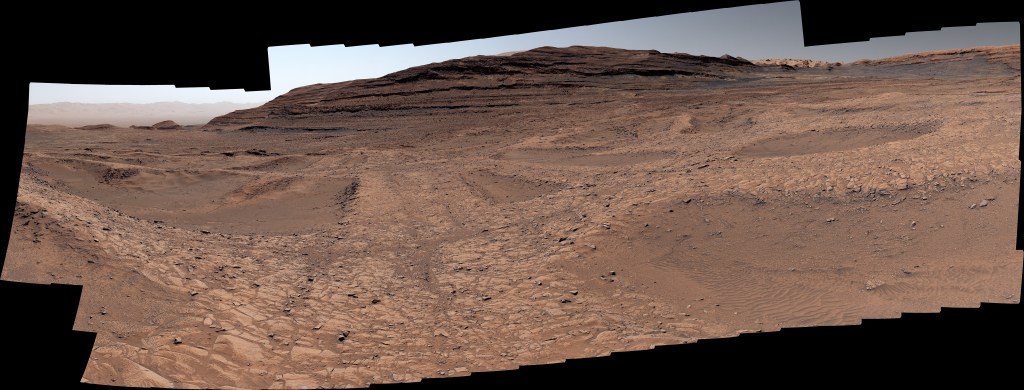

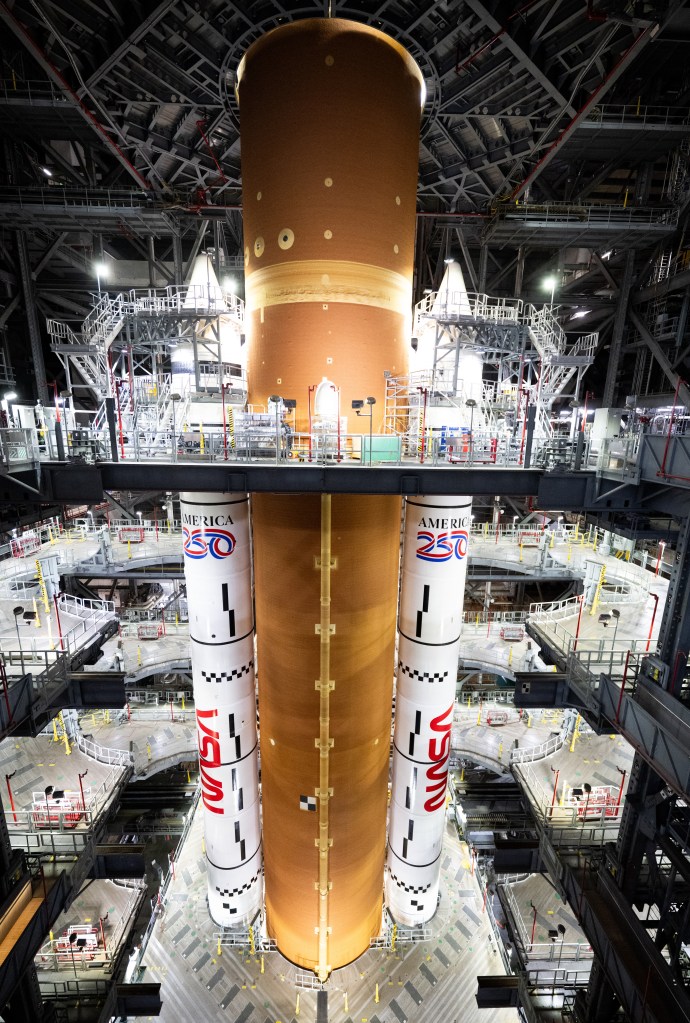

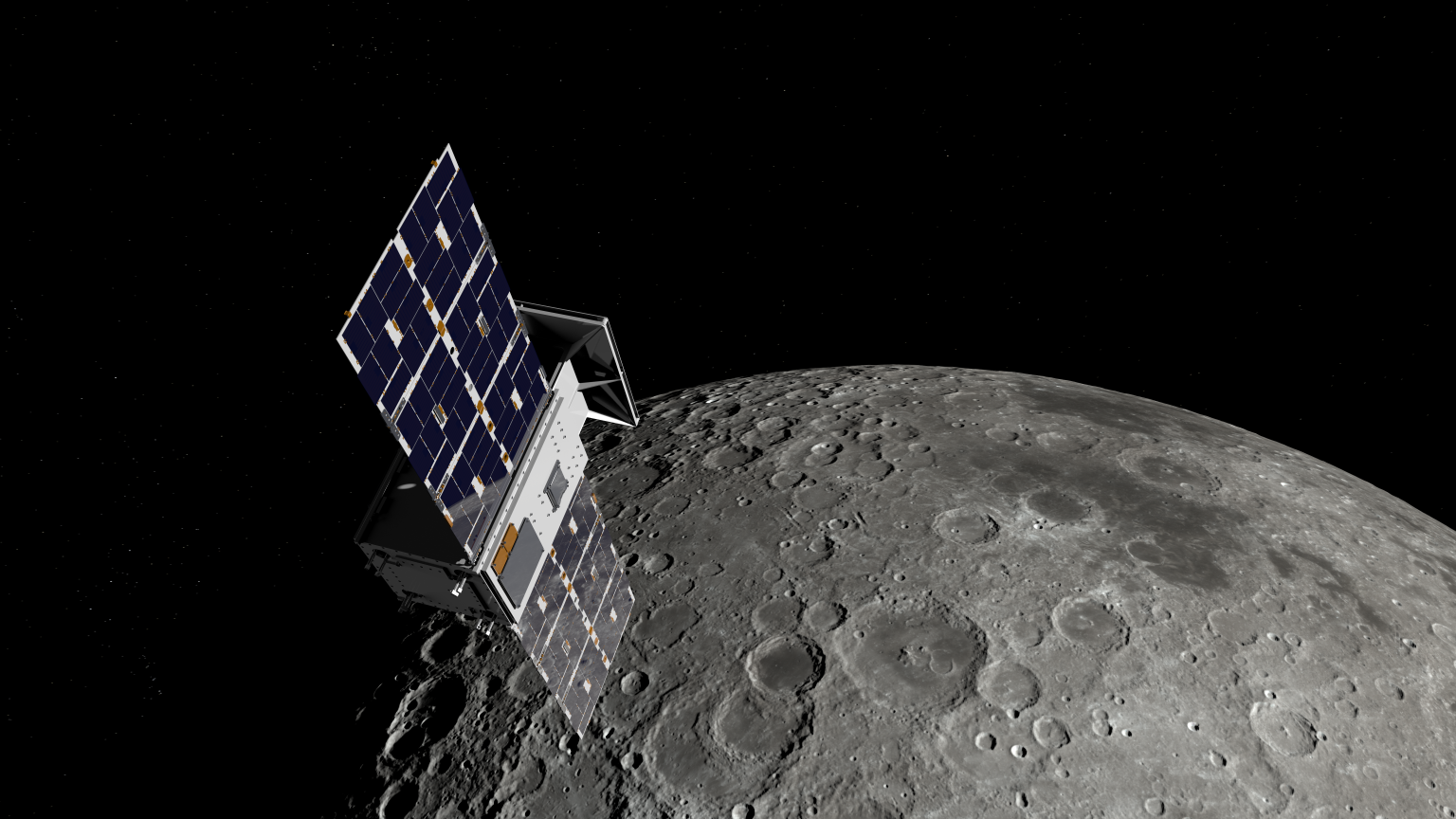

CubeSats have demonstrated current state-of-the-art subsystem technology in a variety of science missions and technology demonstrations in the last decade, giving the SmallSat community a realistic expectation of their advanced capabilities. The common CubeSat form factor is evolving from its initial 1U cube design to accommodate more specific and complex science missions; PocketQubes are now used more widely, and the anticipated DiskSat structure will make its debut in the next few years as an alternative to the “CubeSat” concept. The launch of Artemis I provided a closer step towards a deeper understanding of CubeSat capabilities, achievable destinations, and what the deep space CubeSat form factor may look like in the future.

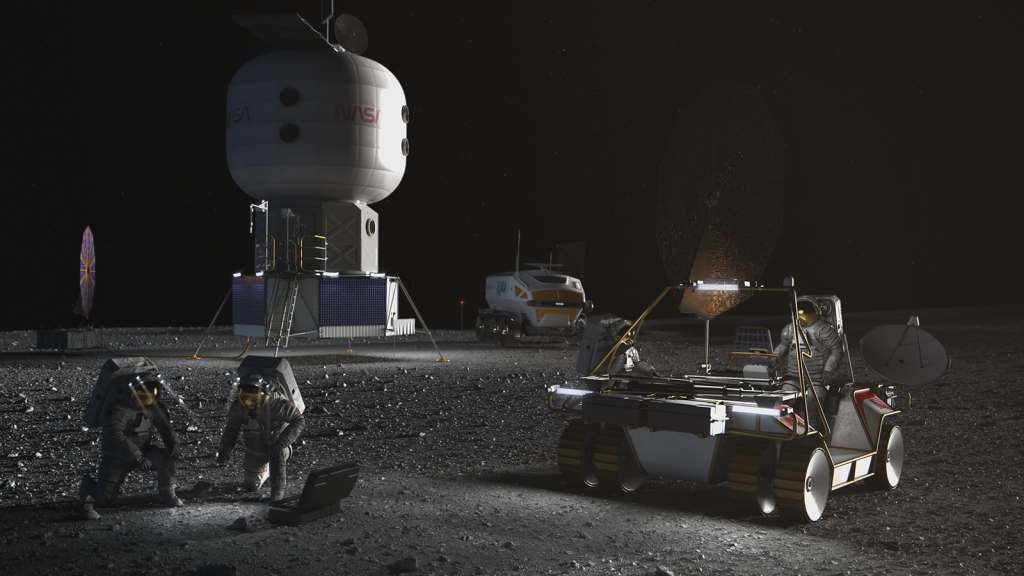

In addition to the technological advancements SmallSats have achieved, launch and hosted payload services are becoming more widespread and several commercial providers are under contract to facilitate the delivery of SmallSat payloads to their destinations. NASA’s Launch Services program’s new Indefinite Delivery/Indefinite Quantity (IDIQ) mechanism through the Venture Class Acquisition of Dedicated and Rideshare (VADR) launch services to accommodate very low complexity CubeSats (up to more complex Class D missions) and provide FAA licensed launch services capable of delivering payloads to a variety of orbits (1). NASA is working with several American companies to deliver science and technology to the lunar surface through the Commercial Lunar Payload Services (CLPS) initiative. Under the Artemis program, these commercial deliveries present SmallSat designers with opportunities to perform science experiments, test technologies and demonstrate capabilities to help NASA explore the Moon and prepare for human missions. Through CLPS, NASA has awarded nine task orders to five providers to deliver over 40 payloads to the surface of the Moon between 2024 and 2026. The NASA CLPS program began delivering science payloads to the Moon in 2023. CLPS contracts are IDIQ contracts with a cumulative maximum contract value of $2.6 billion through 2028. Companies of varying sizes can work with selected vendors and are encouraged to fly commercial payloads in addition to the NASA payloads (2).

This report will be updated annually as emerging technologies mature and become state of the art. Any current technologies that were inadvertently overlooked in this version may be included in subsequent editions. Updates to technologies listed in this report could be also modified in subsequent revisions. Technology inputs, updates, or corrections can be made by reaching out to the editor of this report at arc-sst-soa@mail.nasa.gov.

- NASA Press Release. [Online] Jan 26, 2022. Accessed November 2022. Available at: https://www.nasa.gov/press-release/13-companies-to-provide-venture-class-launch-services-for-nasa

- NASA. “Commercial Lunar Payload Services.” CLPS Brochure 2024. [Online] Available at: https://www.nasa.gov/clps