CCRPP

The Civilian Commercialization Readiness Pilot Program (CCRPP) is a funding opportunity available to small businesses with a primary objective of accelerating the near-term transition of SBIR- and STTR-funded technologies to infusion and/or commercialization, not an incremental improvement in technology maturation alone.

The funding is a combination of additional SBIR/STTR program investment and NASA or non-NASA entity investment. There is a minimum investor funding requirement of $500,000, and the NASA SBIR/STTR program will match between $500,000 and $2.5 million of the external investment. The period of performance is generally 24 months.

| Program Year | Link to Call for Applications | Application Due Date |

|---|---|---|

| 2024 | https://sam.gov/opp/17151fa50ca44fd89a564af2ef3d34cb/view | February 20, 2024 |

| 2023 | https://sam.gov/opp/dc4306735c9c4a1884a54faa116cffbb/view | February 15, 2023 |

Use the below links to jump to the CCRPP information you are looking for:

CCRPP Guidelines | Guidelines on Investments | Application Requirement

For NASA Investments | Post Submission | Previous Awardees

1.0 CCRPP Guidelines

For a CCRPP award, the NASA SBIR/STTR Phase II technology proposed for advancement toward commercialization should have a strong relevance to NASA’s missions, as well as a strong potential use by NASA and/or markets outside of NASA beyond the CCRPP investment. CCRPP funding is planned to be available to companies that have completed their initial Phase II contract, or that have an ongoing or completed Sequential Phase II contract. Completed awards are awards where contract period of performance has expired, and all deliverables have been accepted by the Government.

1.1 Technology Development

The technologies used by NASA require significant iterations between design, development, and testing, both at the component level and as integrated systems, before they can be used in NASA missions or applications. The iterative process between concept, design, testing, and evaluation matures technology on the Technology Readiness Level (TRL). The TRL scale is used to describe the stage of maturity in the development process from observation of basic principles through final product operation. The NASA SBIR/STTR Program funds projects to advance technologies for future NASA applications by starting from a relatively nascent stage in Phase 1, typically TRL 3. Successful Phase I projects that receive Phase II funds will often complete Phase II at TRL 5.

Many companies working on NASA SBIR or STTR projects typically face three challenges:

- Maturing their component technologies to higher TRL values

- Integrating those technologies into more complex systems

- Understanding a variety of customers beyond a potential NASA customer

1.2 Matching Funds

NASA will match the investments with SBIR/STTR program funds between $500,000 and $2.5 million for each CCRPP award. Eligible firms must identify an investor, obtain investment funding, and submit a letter of commitment from an investor to provide matching funds when submitting a CCRPP application. There can be more than one investor for each CCRPP application. The CCRPP award will take the form of a new contract with the firm with the SBIR/STTR program funds; the investor funds will be provided to the firm separately from the CCRPP contract.

The intent of the investment funding is that this is co-funded with new fully obligated/transferred funds that are to be co-spent in parallel to the CCRPP award. Pre-existing investments will not be accepted; funds transferred more than 60 calendar days prior to award will not be accepted. See section 1.5.1 for more information on what does and doesn’t qualify as investments including limitations on in-kind contributions, subcontracting back to the investor, and purchases. If selected, the small business firm will be contacted and notified of the amount of time they will have to have funds transferred and to show proof of funds. Note that NASA does not take funds from the investor; funds must be transferred to the firm.

1.3 Anticipated Budget and Number of Awards

Amount of award is a maximum of $5 million per award ($2.5 million from NASA SBIR/STTR Program funds and $2.5 million from non-SBIR/STTR funds). If the matching funds are from a non-government source, an external arrangement between the small business and the investor must be provided to the government for confirmation. Each company may only receive one CCRPP award per fiscal year.

The NASA SBIR/STTR program anticipates identifying CCRPP Applications selected for contract negotiations by the late spring/early summer time frame. Subject to availability of additional funding, NASA may elect to identify additional CCRPP Applications for contract negotiation. These additional selections, from the Applications already submitted, may be made by August 16, pending funding availability. NASA will provide notice to firms in the event additional funding is identified and their Application is selected for negotiation.

1.4 Who May Apply for a CCRPP Award

NASA’s FY24 CCRPP is available to Small Business Concerns (SBCs) that:

- Have a completed SBIR/STTR Phase II award selected from NASA solicitations issued from approximately the last 10 years (see the CCRPP call for applications on SAM.gov for more detail), and whose Phase II period of performance is complete by the end of the current call for applications.

- NASA SBIR/STTR Phase II-E options resulting from Phase I awards starting in Program Year 2012 or later, regardless of when their period of performance ends.

- Have an ongoing or completed NASA SBIR/STTR Phase II Sequential award.

- The proposed CCRPP work should not duplicate any past or ongoing work. This includes work in other SBIR/STTR contracts irrespective of phase or funding agency or any other equivalent work whether internal or external to NASA

- Have not yet received a CCRPP award (or equivalent awards that use the same authorities such as, but not necessarily limited to, Commercialization Readiness Program (CRP) awards) from any federal Agency for the Phase II technology associated with the Phase II award

- Have secured an investor(s) willing to contribute matching funding to the maturation of the technology detailed in the application of research related to NASA interests

1.5 Definition of an Investor

Investor(s) must be external to the SBIR/STTR Programs, which may include such entities as another company, a venture capital firm, an individual investor, a non-SBIR/STTR government program, or any combination of the above. An external investor cannot include the owners of the small business, their family members, and/or “affiliates” of the small business, as defined in Title 13 of the Code of Federal Regulations (C.F.R.), Section 121.103.

SBIR/STTR Program funds from any agency, including NASA, cannot be used as qualifying investments. This includes Phase I, Phase II, and/or other post-Phase II awards funded via SBIR/STTR Program funds. Phase III contracting mechanisms where the funds are newly obligated from a mission, project, non-SBIR/STTR program, or the like, from any agency, are allowed. Note that a Phase III contract may be the most expedient mechanism to provide investments from NASA or other government agencies; any Federal Agency may enter into a Phase III SBIR/STTR agreement at any time with a Phase II Awardee, regardless of which agency originated the Phase II award.

1.5.1 Specific Examples of What Does and Does Not Qualify As Investment

This section contains questions and answers regarding NASA’s guidance for the types of investment from external investors that qualify as an investment under the CCRPP program. The following includes specific examples of company-investor relationships and whether these relationships qualify as a CCRPP investment or not. If you have questions about whether a particular company-investor relationship qualifies, please contact the NASA SBIR/STTR Helpdesk at agency-sbir@mail.nasa.gov. The Helpdesk will refer any policy or substantive questions to appropriate NASA personnel for an official response. The Helpdesk will refer any policy or substantive questions to appropriate NASA personnel for an official response.

| Question: | Answer: |

|---|---|

| 1. Can a small business contribute its own internal funds to qualify for the CCRPP? | No. NASA is seeking external, third party validation of the technology, and requires that the funds come from an external investor. Please note that a subcontractor of the SBIR/STTR project will not qualify as an external investor. |

| 2. Company A spins off company B, which wins a SBIR award. Company A then wants to contribute matching funds to qualify company B for the CCRPP. Can A be considered an external investor for purposes of the CCRPP? | In making our determination of whether company A is an external investor, we would be guided by the definition of “affiliates” in 13 C.F.R. Sec. 121.103, discussed above. Our presumption is that in this example A and B would be considered “affiliates,” and that A would therefore not be an external investor for purposes of the CCRPP. |

| 3. Small business A wins a SBIR award. The president of A is a major shareholder in another company B, which wants to contribute matching funds to qualify S for the CCRPP. Can B be considered an external investor? | Our presumption is that B would not be considered an external investor. Our determination would be guided by whether the president’s stake in B is large enough that A and B would be considered “affiliates” under 13 C.F.R. Sec. 121.103 . Subsection (c) of Section 121.103 specifically discusses affiliation based on stock ownership: c. Affiliation based on stock ownership. A person is an affiliate of a concern if the person owns or controls, or has the power to control 50 percent or more of its voting stock, or a block of stock which affords control because it is large compared to other outstanding blocks of stock. If two or more persons each owns, controls or has the power to control less than 50 percent of the voting stock of a concern, with minority holdings that are equal or approximately equal in size, but the aggregate of these minority holdings is large as compared with any other stock holding, each such person is presumed to be an affiliate of the concern. If A and B are found to be affiliates, we would determine that B is not an external investor. |

| 4. Does the external investor have to be a single entity (e.g., a single venture capital firm) or can it be more than one entity (e.g., two angel investors and a venture capital firm)? | It can be more than one entity. |

| 5. Small business A contributes matching funds to small company B in order to qualify B for the CCRPP, and, at the same time, B contributes matching funds to A in order to qualify A for the CCRPP. Do A and B qualify as external investors under the CCRPP? | No. A and B’s relationship is such that their investment in each other would not provide external validation of the commercial potential of their respective SBIR projects. We would therefore not consider them to be external investors for purposes of the CCRPP. |

| 6. Can a family member of an employee of small business A contribute funds to qualify A for the CCRPP? | No, except under rare circumstances. Again, we would be guided by the definition of “affiliates” in 13 C.F.R. Sec. 121.103. The family member presumptively would be an affiliate of company A and not an external investor. |

| 7. Venture capital firm A currently is a 22 percent shareholder in small company B. Can A invest additional funds in B to qualify B for the CCRPP? | Our presumption is yes. In making our determination, we would be guided by whether A and B are “affiliates,” as defined in 13 C.F.R. Sec. 121.103. Section 121.103 provides (in subsection (b)(5)) that a venture capital firm is not affiliated with a company if the venture capital firm does not control the company, e.g., by owning more than 50 percent of the stock of a small company (prior to its investment under the CCRPP), as described in 13 C.F.R. 107.865. |

| 8. Large company A makes a cash investment in small company B, and then serves as a subcontractor to B on an SBIR project. Can A’s investment in B count as a matching contribution for purposes of the CCRPP? | Only A’s cash investment net of its subcontracting effort can count as matching funds for purposes of CCRPP. For example, if A invests $750,000 in B and subcontracts with B for $250,000, only A’s net contribution ($500,000) can count as matching funds for purposes of the CCRPP. |

| 9. Company A makes a cash investment in small company B for purposes of CCRPP, and also enters into a separate contract with B under which A provides certain goods/services to B in return for $500,000. Can A’s cash investment in B count as a matching contribution for purposes of the CCRPP? | As in the previous example, only A’s cash investment net of the $500,000 it receives from B can count as matching funds for purposes of the CCRPP. |

| 10. A group of investors wishes to invest funds in small company A to qualify A for the CCRPP. One of the investors is a family member of A’s president, who wants to contribute $50,000 toward the effort. Can the group’s investment in A count as a matching contribution to qualify A for the CCRPP? | The family member’s investment of $50,000 does not count, as the family member is not an external investor (see item (6) above). Contributions of the other investors can count provided that they meet the other conditions for the CCRPP (e.g., each must be an external investor). |

| 11. Can a loan from an external party qualify as an “investment” for purposes of the CCRPP? | No. The rationale behind the CCRPP is that an external party is betting on the company’s success in bringing the technology to market as an investor, not just its ability to recover a loan as a lender. |

| 12. How about a loan that is convertible to equity? | A loan that is convertible to equity at the company’s discretion would count as an investment under the following circumstances: (1) the loan is provided by a public entity (e.g., a state agency), or (2) the loan is provided by a private entity, and the SBIR company actually converts the loan to equity before the CCRPP contract is executed. |

| 13. Can in-kind contributions from an external investor count as matching funds under the CCRPP? | No. The matching contribution must be in funds, regardless of source. A cash contribution is a stronger signal of the external investor’s interest in the technology, and can be readily verified. |

| 14. Can purchases of a purchase order from an external investor count as a matching contribution under the CCRPP? | No. Purchases will not be considered an investment, since a purchase may only represent a procurement need, not a desire to further the technology. Refer to question 15. |

| 15. If large company A pays small company B for work related to B’s SBIR project and expects a deliverable (goods or services) from B in return, would that qualify as an “investment”? | This arrangement would not qualify as an investment for the same reason a loan does not qualify. Specifically, in this situation the large company is not betting on the small company’s success in bringing the technology to market, but merely is looking to purchase a deliverable. Refer to item 14. |

| 16. Can entity A’s investment in small company B during the first month of B’s Phase I SBIR project count as a matching contribution to qualify B for the CCRPP? | No. The investment must occur within 45 calendar days of the company’s notification of selection, without constraints or contingencies. |

| 17. Small company A is collaborating with a university on an STTR project. Investor B wishes to provide funds to the university in order to qualify A for the STTR CCRPP. Can B’s investment in the university count as a matching contribution to qualify A for the CCRPP? | In order to qualify A for the STTR CCRPP, B’s investment of funds must be in small company A, not in the university. A can then subcontract some of the funds to the university. |

| 18. Must the activities funded by the investor be explained in the application’s statement of work for the small company’s CCRPP? | Yes. The external investor’s funds must pay for activities that further the development and/or commercialization of the company’s Phase II work. Including this information in the application assists with verification. |

| 19. Our small business has existing contracts and/or grants (non-Federal Government Organization). Can these count as matching investments? | Yes, if the existing contract or grant is directly related to the CCRPP work proposed and the money targeted for the CCRPP effort has not yet been obligated/transferred to the firm. Funds obligated/transferred more than 60 calendar days prior to notification of selection will not be accepted as qualifying investments. |

| 20. Our small business has existing NASA or Other Government Agency contracts and/or grants. Can these count as matching investments? | Yes, if the existing contract or grant is directly related to the CCRPP work proposed and the money targeted for the CCRPP effort has not yet been obligated/transferred to the firm, then funds transferred at the time of the CCRPP award may be counted towards the match; e.g., a Phase III contract for the same technology or a modification and funding for another contract that specifically relates to the technology. NASA and other Government Agency funds obligated/transferred more than 90 calendar days prior to notification of selection will not be accepted as qualifying investments nor will incremental future funds be accepted as qualifying investments. Second, the small business will need to receive a Modification for the existing government contract to reflect the support of the CCRPP effort. The Modification must include the following information: SBIR or STTR Phase II title, SBIR or STTR Phase II contract number, Summary of the CCRPP effort to be funded with the Modification, Amount of newly obligated/transferred funding for the CCRPP effort. |

| 21. Can my investment be from an international partner? | Potentially yes; however, limitations exist including, but not limited to, firms should be aware of export control and ITAR/EAR restrictions regarding dissemination of research in establishing agreements with their investors. It is the responsibility of the firm to verify that they are not violating pertinent regulations. Also, investments will not be accepted from countries on the NASA list of “Designated Countries” and other countries from which NASA may be prohibited from doing business with. Proof of qualifying/acceptable investment is subject to the discretion of and acceptance by the Contracting Officer and in accordance with any applicable policy, statute, or regulation. This NASA list of “Designated Countries” is a compilation of countries with which the United States: Has no diplomatic relations, Countries determined by Department of State to be “State Sponsors of Terrorism” or identified by the Department of Commerce as “Terrorist Supporting Countries”, Countries under Sanction or Embargo by the United States, or Countries of Missile Technology Concern. Please see: https://www.nasa.gov/sites/default/files/atoms/files/designated_country_list_02_01_2021.pdf (note that this is a dated pdf, please confirm the latest version prior to submission). |

2.0 General Guidance on What Qualifies As Investment

The investment must be used to fund work that directly furthers the work done in the Phase II.

Commitment must be made prior to the award, but the expenditure must be concurrent with the CCRPP performance. The Federal Agency or NASA internal investor’s funds must pay for activities that further the development and/or commercialization of the company’s SBIR/STTR technology beyond the Phase II work (e.g., further R&D, manufacturing, marketing, etc.).

Non-Federal agency investments must be an arrangement in which the external investor provides funding to the small business in return for such items as: equity, a share of royalties, rights in the technology, a percentage of profit, or any combination of the above. Additional funding associated with CCRPP shall further the technology of the original SBIR Phase II contract.

For investments from sources external to the Federal Government, NASA considers factors such as ownership, management, previous relationships with or ties to another concern and contractual relationships, in determining whether affiliation exists. Individuals or firms that have identical or substantially identical business or economic interests, such as family members, persons with common investments, or firms that are economically dependent through contractual or other relationships, may be treated as one party with such interests aggregated.

Note that submission and/or selection of your application for award does not constitute an acceptance of the investment. Contract award will be contingent on acceptable proof of investment, and proof of qualifying/acceptable investment is subject to the discretion of and acceptance by the Contracting Officer and in accordance with any applicable policy, statute, or regulation.

NASA Flight Opportunities is interested in participating as a Post-Phase II investor, specifically for the use of suborbital flight testing to help advance development or commercialization of the technology. Note that the Flight Opportunities investment is unlikely to meet the $500K matching requirement without other investment sources. Learn more about FO investment

2.1 Letter of Commitment Guidelines

A letter of commitment from the investor shall be provided during the application period (similar documentation without a corresponding commitment letter will not be accepted). Use the CCRPP Letter of Commitment template available in the Templates section at the top of this page. The letter of commitment must contain the following information:

- The investor contact information including their business address, title, email address, phone number, signature, and be on official letterhead

- The investor’s willingness to verify the commitment

- The total amount of the investment, accompanying an acknowledgment that the investment is being made in response to and referencing the company’s specific Phase II R&D effort

- An acknowledgment that the entire amount of unencumbered matching funds will be available and transferred within 45 calendar days of the small business notification that it has been selected for a CCRPP Contract without constraints or contingencies.

- Indicate if the investor is also the customer for this CCRPP project as described in the technical application form

- Describe how the investor/customer plans to use or deploy the technology

- Statement of investment use and timeline of need

- For an investment from NASA or other Government agency, the statement shall include a brief statement of how the resulting CCRPP technology will be integrated into the program’s or agency’s future activities, and if future funding to the Small Business Concern is planned or expected above and beyond the CCRPP effort. Include a brief statement of the impact of this project on the Agency

- For investment(s) from a private sector investor, it should include a brief statement of how the investment will further the technology originally proposed in the Phase II, or the commercialization of a product resulting from the Phase II. Include a brief statement of the anticipated impact of this project

- Timeline on dates when the investor or identified customer needs the resulting technology or product

The investor letter must clearly identify the small business firm name that this investment commitment is being provided to and this must be consistent with the firm who is submitting the CCRPP application. For NASA project investments, please refer to ‘NASA Investments’ for additional guidance. Letters of commitment will be reviewed for compliance and we strongly recommend using the provided template. Inadequate and/or non-compliant letters will result in the application being deemed ineligible for award without further evaluation.

3.0 Application Requirements

What needs to be submitted online for a CCRPP Application?

The following items must be submitted electronically via the Electronic Handbook (EHB). Applications that are non-compliant, non-responsive, incomplete, or otherwise do not contain required information at the submission deadline may result in the application being deemed ineligible for award without further evaluation.

- Firm Certifications: Provide information about the Firm. Firm Certifications are collected at the Firm level and are applicable to all applications.

- Firm Certifications will be required during submission, during contract negotiations after award, and throughout contract performance. Note that the submitting firm must certify that they are still a small business at both submission and, if selected, during contract negotiations after award.

- The CCRPP application must be submitted in the EHB under the correct firm name in accordance with SAM.gov registration.

- Audit Information: Although firms are not required to have an approved accounting system, the knowledge that a firm has an approved accounting system facilitates NASA’s determination that rates are fair and reasonable. The Contracting Officer will use this audit information to assist with negotiations if the application is selected for an award. The Contracting Officer will advise offerors on what is required to determine reasonable costs and/or rates in the event the Audit Information is not adequate to support the necessary determination of rates. The offeror shall complete the questions in the Audit Information form regarding the firm’s rates and upload the Federal agency audit report or related information that is available from the last audit. There is a separate Audit Information section in the Budget form that shall also be completed. If your firm has never been audited by a federal agency, then answer “No” to the first question and you do not need to complete the remainder of the form. The designated firm administrator, typically the first person to register your firm, is the only individual authorized to update the audit information.

- Prior Awards Addendum: Provide information about prior Phase I/II awards. Prior Awards Addendum is required if the Firm has received more than 15 SBIR or STTR Phase II in the prior five fiscal years.

- Commercial Metrics Survey: Provide information about Phase I/II awards, Phase II project commercialization information, a brief commercialization narrative, and a POC to verify/maintain the commercialization information.

- Contact Information: Provide contact information for the Authorized Contract Negotiator (ACN), Principal Investigator (PI) and Business Official (BO) for the application

- Application Certifications: Provide information about the application. Application Certifications are collected at an application level and applicable only to the application it is completed for.

- The primary employment of the Principal Investigator (PI) shall be with the small business. Primary employment means that more than 50 percent of the PI’s total employed time (including all concurrent employers, consulting, and self-employed time) is spent with the small business at time of award and during the entire period of performance. Primary employment with an SBC precludes full-time employment at another organization. If the PI does not currently meet these primary employment requirements, then the offeror must explain how these requirements will be met if the proposal is selected for contract negotiations that may lead to an award. Co-Principal Investigators are not allowed.

- Note: NASA considers a full-time workweek to be nominally 40 hours and considers a 19.9-hour or more workweek elsewhere to be in conflict with this rule. In rare occasions, minor deviations from this requirement may be necessary; however, any minor deviation must be approved in writing by the Contracting Officer after consultation with the NASA SBIR/STTR Program Manager/Business Manager.

- CCRPP applications can be submitted based on prior NASA SBIR or STTR Phase II awards. CCRPP applications from STTR Phase II awards do not need to meet STTR requirements for Research Institution (RI) participation levels. However, you must still be compliant with your prior allocation of rights agreement with your RI. You may be required to submit your allocation of rights agreement and/or documentation showing that the Research Institution is releasing their rights showing compliance during contract negotiations in order for the contract to be awarded.

- The primary employment of the Principal Investigator (PI) shall be with the small business. Primary employment means that more than 50 percent of the PI’s total employed time (including all concurrent employers, consulting, and self-employed time) is spent with the small business at time of award and during the entire period of performance. Primary employment with an SBC precludes full-time employment at another organization. If the PI does not currently meet these primary employment requirements, then the offeror must explain how these requirements will be met if the proposal is selected for contract negotiations that may lead to an award. Co-Principal Investigators are not allowed.

- Application Summary: Provide the TRL, a brief summary of the application, duration (in months), and potential NASA- and Non-NASA applications.

- The anticipated Period of Performance (POP) is 24 months. The proposed POP may not exceed 30 months.

- CCRPP Technical Application: Provide the rationale, strategy, actions, roles and responsibilities of participants to mature the identified SBIR/STTR technology product and/or service for the specified application and customer. This includes Objectives, Commercialization Information, and Implementation Approach. The Commercialization Plan includes details on market feasibility and competition strategy, commercialization strategy, key management/technical personnel/organizational structure, financial strategy, and intellectual property plans.

- Note: The Technical Application must be completed offline and uploaded as part of the application.

- Application Budget: Provide the budget summary including estimated costs with detailed information for Direct Labor, Overhead, ODCs, Subcontractors/Consultants, G&A, Profit/Cost Sharing, and the Investor(s). This information will be populated via an EHB form.

- Note that the budget will require information for the efforts being conducted with both the SBIR/STTR Program matching funds as well as the external investment funds.

- All proposed subcontracted business arrangements, including consultants, must not exceed 50 percent of the research and/or analytical work [as determined by the total cost of the proposed subcontracting effort (to include the appropriate overhead (OH) and general and administrative expenses (G&A) in comparison to the total effort (total contract price including cost sharing, if any, less profit, if any)].

- Briefing Chart: Provide brief information on Identification and Significance of Innovation, Technical Objectives and Work Plan Summary, Firm Contact, and an image. The Briefing Chart will also display the NASA and Non-NASA Applications from the Application Summary form. The Briefing Chart should include the starting and ending Technology Readiness Level (TRL) values.

- Letter(s) of Commitment: Provide a letter of commitment from the Investor(s). This is an agreement between the applicant and the investor that the SBIR/STTR project has demonstrated sufficient results and that expansion and acceleration of project efforts in line with NASA interests are justified. A letter of commitment is required from each Investor of the project effort. Use the CCRPP Letter of Commitment template available in the Templates section at the top of this page.

Application Format Requirements

A CCRPP Technical Application shall not exceed a total of 30 standard 8 1/2 x 11 inch (21.6 x 27.9 cm) pages, not including the required forms. Each page shall be numbered consecutively at the bottom. Margins shall be 1.0 inch (2.5 cm). All required items of information must be covered in the application and will count towards the total page count. The space allocated to each part of the technical content will depend on the project chosen and the applicant’s approach.

Note: The Government administratively screens all applications and reserves the right to reject any application that does not conform to the formatting requirements.

Use the CCRPP Technical Application template available in the Templates section at the top of this page.

3.1 Application Deadline

Complete applications are due in the Electronic Handbook by 5 p.m. ET on the day of the application period closure.

A complete application includes all sections of applications as required by section 3.0 and other information required by the EHB. A complete application must be fully submitted by this time as the EHB module will close.

If you attempt to submit after the closure of the application submission module you may receive an error message; submissions/last sections not submitted prior to the deadline will not be accepted in the system as complete. If your application is not fully complete, it will deemed ineligible for award without further evaluation. We strongly advise applicants to complete your application prior to the final days of the application period. Note that, close to the end of the application period, the help desk may not be able to answer the large volume of questions in a timely manner; open questions submitted to the help desk will not be accepted as an excuse for incomplete applications.

3.2 Definitions

Brassboard: A medium fidelity functional unit that typically tries to make use of as much operational hardware/software as possible and begins to address scaling issues associated with the operational system. It does not have the engineering pedigree in all aspects, but is structured to be able to operate in simulated operational environments in order to assess performance of critical functions

Breadboard: A low fidelity unit that demonstrates function only, without respect to form or fit in the case of hardware, or platform in the case of software. It often uses commercial and/or ad hoc components and is not intended to provide definitive information regarding operational performance

Engineering Unit: A high fidelity unit that demonstrates critical aspects of the engineering processes involved in the development of the operational unit. Engineering test units are intended to closely resemble the final product (hardware/software) to the maximum extent possible and are built and tested so as to establish confidence that the design will function in the expected environments. In some cases, the engineering unit will become the final product, assuming proper traceability has been exercised over the components and hardware handling

Laboratory Environment: An environment that does not address in any manner the environment to be encountered by the system, subsystem, or component (hardware or software) during its intended operation. Tests in a laboratory environment are solely for the purpose of demonstrating the underlying principles of technical performance (functions), without respect to the impact of environment

Manufacturability: Extent to which a good can be manufactured with relative ease at minimum cost and maximum reliability. The general engineering art of designing products in such a way that they are easy to manufacture

Mission Configuration: The final architecture/system design of the product that will be used in the operational environment. If the product is a subsystem/component, then it is embedded in the actual system in the actual configuration used in operation

Operational Environment: The environment in which the final product will be operated. In the case of space flight hardware/software, it is space. In the case of ground-based or airborne systems that are not directed toward space flight, it will be the environments defined by the scope of operations. For software, the environment will be defined by the operational platform

Proof of Concept: Analytical and experimental demonstration of hardware/software concepts that may or may not be incorporated into subsequent development and/or operational units

Proto-type Unit: The prototype unit demonstrates form, fit, and function at a scale deemed to be representative of the final product operating in its operational environment. A subscale test article provides fidelity sufficient to permit validation of analytical models capable of predicting the behavior of full-scale systems in an operational environment

Relevant Environment: Not all systems, subsystems, and/or components need to be operated in the operational environment in order to satisfactorily address performance margin requirements. Consequently, the relevant environment is the specific subset of the operational environment that is required to demonstrate critical “at risk” aspects of the final product performance in an operational environment. It is an environment that focuses specifically on “stressing” the technology advance in question

3.3 Technology Readiness Level (TRL) Descriptions

The TRL describes the stage of maturity in the development process from observation of basic principles through final product operation. Exit criteria, documenting principles and concepts, determine when applications or performance have been satisfactorily demonstrated in the appropriate environment required for that level, as shown in the table below.

Table 1: TRL Descriptions

| TRL | Definition | Hardware Description | Software Description | Exit Criteria |

|---|---|---|---|---|

| 1 | Basic principles observed and reported | Scientific knowledge generated underpinning hardware technology concepts/applications | Scientific knowledge generated underpinning basic properties of software architecture and mathematical formulation | Peer reviewed publication of research underlying the proposed concept/application |

| 2 | Technology concept and/or application formulated | Invention begins, practical application is identified but is speculative, no experimental proof or detailed analysis is available to support the conjecture | Practical application is identified but is speculative, no experimental proof or detailed analysis is available to support the conjecture. Basic properties of algorithms, representations and concepts defined. Basic principles coded. Experiments performed with synthetic data | Documented description of the application/concept that addresses feasibility and benefit |

| 3 | Analytical and experimental critical function and/or characteristic proof of concept | Analytical studies place the technology in an appropriate context and laboratory demonstrations, modeling and simulation validate analytical prediction | Development of limited functionality to validate critical properties and predictions using non-integrated software components | Documented analytical/experimental results validating predictions of key parameters |

| 4 | Component and/or breadboard validation in laboratory environment | A low fidelity system/component breadboard is built and operated to demonstrate basic functionality and critical test environments, and associated performance predictions are defined relative to the final operating environment | Key, functionally critical, software components are integrated, and functionally validated, to establish interoperability and begin architecture development. Relevant Environments defined and performance in this environment predicted. | Documented test performance demonstrating agreement with analytical predictions. Documented definition of relevant environment. |

| 5 | Component and/or breadboard validation in relevant environment | A medium fidelity system/component pressboard is built and operated to demonstrate overall performance in a simulated operational environment with realistic support elements that demonstrates overall performance in critical areas. Performance predictions are made for subsequent development phases. | End-to-end software elements implemented and interfaced with existing systems/simulations conforming to target environment. End-to-end software system, tested in relevant environment, meeting predicted performance. Operational environment performance predicted. Prototype implementations developed. | Documented test performance demonstrating agreement with analytical predictions. Documented definition of scaling requirements. |

| 6 | System/sub-system model or prototype demonstration in a relevant environment | A high fidelity system/component prototype that adequately addresses all critical scaling issues is built and operated in a relevant environment to demonstrate operations under critical environmental conditions. | Prototype implementations of the software demonstrated on full-scale realistic problems. Partially integrate with existing hardware/software systems. Limited documentation available. Engineering feasibility fully demonstrated. | Documented test performance demonstrating agreement with analytical predictions |

| 7 | System prototype demonstration in an operational environment | A high fidelity engineering unit that adequately addresses all critical scaling issues is built and operated in a relevant environment to demonstrate performance in the actual operational environment and platform (ground, airborne, or space) | Prototype software exists having all key functionality available for demonstration and test. Well integrated with operational hardware/software systems demonstrating operational feasibility. Most software bugs removed. Limited documentation available. | Documented test performance demonstrating agreement with analytical predictions |

| 8 | Actual system completed and “flight qualified” through test and demonstration | All software has been thoroughly debugged and fully integrated with all operational hardware and software systems. All user documentation, training documentation, and maintenance documentation completed. All functionality successfully demonstrated in simulated operational scenarios. Verification and Validation (V&V) completed. | Prototype software exists having all key functionality available for demonstration and test. Well integrated with operational hardware/software systems demonstrating operational feasibility. Most software bugs removed. Limited documentation available. | Documented test performance demonstrating agreement with analytical predictions |

| 9 | Actual system flight proven through successful mission operations | The final product is successfully operated in an actual mission | All software has been thoroughly debugged and fully integrated with all operational hardware/software systems. All documentation has been completed. Sustaining software engineering support is in place. System has been successfully operated in the operational environment. | Documented mission operational results |

3.4 Manufacturing Readiness Level (MRL) Descriptions

Table 2: MRL Descriptions

| Stage | MRL | Definition | Description |

|---|---|---|---|

| Material Solutions Analysis | 1 | Basic manufacturing implications identified | Basic research expands scientific principles that may have manufacturing implications. The focus is on a high level assessment of manufacturing opportunities. The research is unfettered. |

| 2 | Manufacturing concepts identified | Invention begins. Manufacturing science and/or concept described in application context. Identification of material and process approaches are limited to paper studies and analysis. Initial manufacturing feasibility and issues are emerging. | |

| 3 | Manufacturing proof of concept developed | Conduct analytical or laboratory experiments to validate paper studies. Experimental hardware or processes have been created, but are not yet integrated or representative. Materials and/or processes have been characterized for manufacturability and availability but further evaluation and demonstration is required. | |

| 4 | Capability to produce the technology in a laboratory environment | Required investments, such as manufacturing technology development identified. Processes to ensure manufacturability and quality are in place and are sufficient to produce technology demonstrators. Manufacturing risks identified for prototype build. Manufacturing cost drivers identified. Manufacturability assessments of design concepts have been completed. Key design performance parameters identified. Special needs identified for tooling, facilities, material handling and skills. | |

| Technology Development | 5 | Capability to produce prototype components in a production relevant environment | Manufacturing strategy refined and integrated with Risk Management Plan. Identification of enabling/critical technologies and components is complete. Prototype materials, tooling and test equipment, as well as personnel skills, have been demonstrated on components in a production relevant environment, but many manufacturing processes and procedures are still in development. Manufacturing technology development efforts initiated or ongoing. Manufacturability assessments of key technologies and components ongoing. Cost model based upon detailed end-to-end value stream map. |

| 6 | Capability to produce a prototype system or subsystem in a production relevant environment | Initial manufacturing approach developed. Majority of manufacturing processes have been defined and characterized, but there are still significant engineering/design changes. Preliminary design of critical components completed. Manufacturability assessments of key technologies complete. Prototype materials, tooling and test equipment, as well as personnel skills have been demonstrated on subsystems/ systems in a production relevant environment. Detailed cost analysis includes design trades. Cost targets allocated. Manufacturability considerations shape system development plans. Long lead and key supply chain elements identified. Industrial Capabilities Assessment for Milestone B completed. | |

| Engineering and Manufacturing Development | 7 | Capability to produce systems, subsystems or components in a production representative environment | Detailed design is underway. Material specifications are approved. Materials available to meet planned pilot line build schedule. Manufacturing processes and procedures demonstrated in a production representative environment. Detailed manufacturability trade studies and risk assessments underway. Cost models updated with detailed designs, rolled up to system level and tracked against targets. Unit cost reduction efforts underway. Supply chain and supplier Quality Assurance assessed. Long lead procurement plans in place. Production tooling and test equipment design and development initiated. |

| 8 | Pilot line capability demonstrated. Ready to begin low rate production. | Detailed system design essentially complete and sufficiently stable to enter low rate production. All materials are available to meet planned low rate production schedule. Manufacturing and quality processes and procedures proven in a pilot line environment, under control and ready for low rate production. Known manufacturability risks pose no significant risk for low rate production. Engineering cost model driven by detailed design and validated. Supply chain established and stable. Industrial Capabilities Assessment for Milestone C completed. | |

| Production and Deployment | 9 | Low Rate Production demonstrated. Capability in place to begin full rate production. | Major system design features are stable and proven in test and evaluation. Materials are available to meet planned rate production schedules. Manufacturing processes and procedures are established and controlled to three-sigma or some other appropriate quality level to meet design key characteristic tolerances in a low rate production environment. Production risk monitoring ongoing. LIRP cost goals met, learning curve validated. Actual cost model developed for Full Rate Production environment, with impact of Continuous improvement. |

| Operations and Support | 10 | Low Rate Production demonstrated. Capability in place to begin full rate production. | This is the highest level of production readiness. Engineering/design changes are few and generally limited to quality and cost improvements. System, components or items are in rate production and meet all engineering, performance, quality and reliability requirements. All materials, manufacturing processes and procedures, inspection and test equipment are in production and controlled to six-sigma or some other appropriate quality level. Full Rate Production unit cost meets goal, and funding is sufficient for production at required rates. Lean practices well established and continuous process improvements ongoing. |

4.0 For NASA Investments

The SBIR/STTR Program does not take invested funds from a NASA or Other Government Agency (OGA) project; funds need to be provided to the firm via a separate contract. This can be done by a direct, non-competed Phase III contract with the firm. Contact the pertinent center SBIR Technology Transition Points of Contact for more information on the Phase III contract process.

Note that existing contracts with the firm can be utilized but not pre-obligated funds. New obligations are required; see section 1.5.1 for more details. Note that contract modifications may be required.

While the intent is that invested funds are provided after award, NASA contracts may have funds obligated prior to selection. However, note that funds obligated more than 60 calendar days prior to notification of selection will not be accepted as qualifying investments unless the start date of the contract has been set to fall within the period for acceptable investments around notification of selection that meet the intent of co-funding. If you are using a contract that already exists, or is under negotiation, please cite that in your Letter of Commitment, including the contract number, if it exists, or else cite that it is under negotiation and include any pertinent identification information that you may have (e.g. title). If the CCRPP application is selected, acceptability of investments is subject to the approval by the Contracting Officer during contract negotiations. Note that this obligation/start date exception exists only for NASA contracts.

Please be aware of any program/project internal and center approval processes that may affect the timeliness of providing your investment to the firm.

Note that contracts must be fully funded; the NASA SBIR/STTR program can only award CCRPP contracts in a 1:1 ratio and invested funds must be fully obligated prior to the start of the CCRPP contract.

- Note that NASA contracts that are being incrementally funded or funded with milestones may be acceptable; however, the SBIR/STTR program will only match newly obligated increments/milestones that are obligated between 60 calendar days prior to notification of selection through 45 calendar days after notification of selection. Refer to section 1.5.1 for additional details that may be applicable.

4.1 Letter of Commitment

Please be aware of any program/project internal and center approval processes in providing your letter of commitment to the firm.

If you are using a contract that already exists, or is under negotiation, please cite that in your Letter of Commitment; cite the contract number, if it exists, else cite that it is under negotiation and pertinent identification information that you may have (e.g. title).

5.0 Post-Submission

Note that notifications of ineligibility, non-selection, and/or selection may go only to the listed firm business official.

In the event that your company is either: 1) no longer eligible as a small business; 2) no longer has matching investors willing to commit the minimum match ($500K); or 3) would otherwise like to withdraw your Application, please provide documentation (letter or email) indicating your intent to withdraw the Application to the SBIR/STTR helpdesk at agency-sbir@mail.nasa.gov.

5.1 For Selectees

Firms with applications that are selected for negotiation of a contract will be notified via email. The NASA Shared Services Center (NSSC) Procurement Office will be responsible for contract negotiation which may result in an award.

Firms must show proof of funds transferred from the outside Investor(s) to the firm for the SBIR/STTR matching funds within 45 calendar days of selection notification. These materials must be provided to the negotiating NSSC Procurement processor or Procurement Specialist.

The Contract Specialist will contact the firm shortly after notification of selection to negotiate any outstanding items and to discuss terms and conditions. If negotiations are a success, a preliminary copy of the contract will then be submitted for the firm’s review and signature.

The Authorized Contract Negotiator (ACN) for this award will receive an e-mail notification within a few business days with instructions on accessing the contract in the Awardee Firm’s Electronic Handbook.

The company, as well as the company’s employees, consultants, subcontractors or partners are NOT AUTHORIZED to commence work or incur any costs until they receive the official executed contract signed by the Contracting Officer.

5.2 For Non-Selectees

Subject to availability of additional funding, NASA may elect to identify additional CCRPP Applications for contract negotiation. These additional selections, from the Applications already submitted, may be made by August 16th, pending funding availability. NASA will provide notice to firms in the event additional funding is identified and their Application is selected for negotiation.

NASA is unable to accept updates to CCRPP Applications. For any additional selections, NASA will determine eligibility of investment(s) at the time of selection on an individual basis; NASA will not be addressing any questions on non-selected CCRPP Applications. Any questions or changes to your Application package or investment will only be addressed if selected and will have to be discussed during contract negotiation with the Contracting Officer and changes will be subject to their approval.

Please note that NASA will not respond to any questions related to non-selected Applications.

No feedback or debriefs will be provided for CCRPP applications. This includes applications that are deemed ineligible for award, non-selected for award, or selected for award.

Previous Awardees

In 2023, four applications were selected for award for a total of $8.6M in funding. A list of selected projects and firms can be found below:

| 2023 Awardee Firm Name | Award Title |

| Electric Power Systems, Inc. | Active Battery Management System with Physics Based Life Modeling Topology |

| Resilienx | Commercialization of Weather Sensor Data Monitoring Through a Comprehensive In-Time Aviation Safety Management System… |

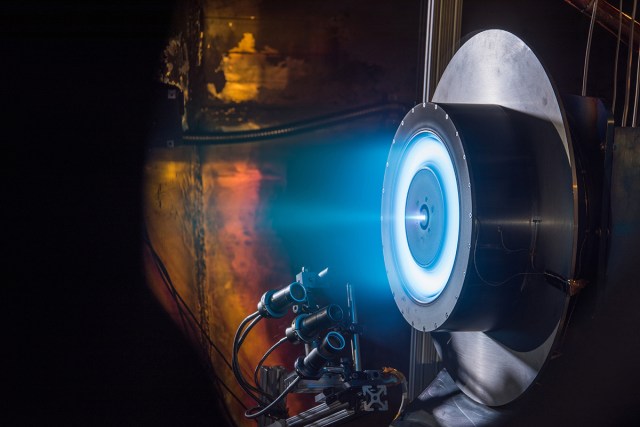

| Alameda Applied Sciences Corporation | High-Impulse, Scalable, Metal Plasma Thruster for Cubesat Missions |

| Psionic, LLC | Navigation Doppler Lidar System on Module |