[The following is the text of a speech given by Phil McAlister, Director of the Commercial Space Division at NASA Headquarters, during the May 2022 “Commercial Human Spaceflight Workshop” sponsored annually by SAS Aerospace in Boulder Colorado. The speech was updated in March 2023 for posting on the NASA website.]

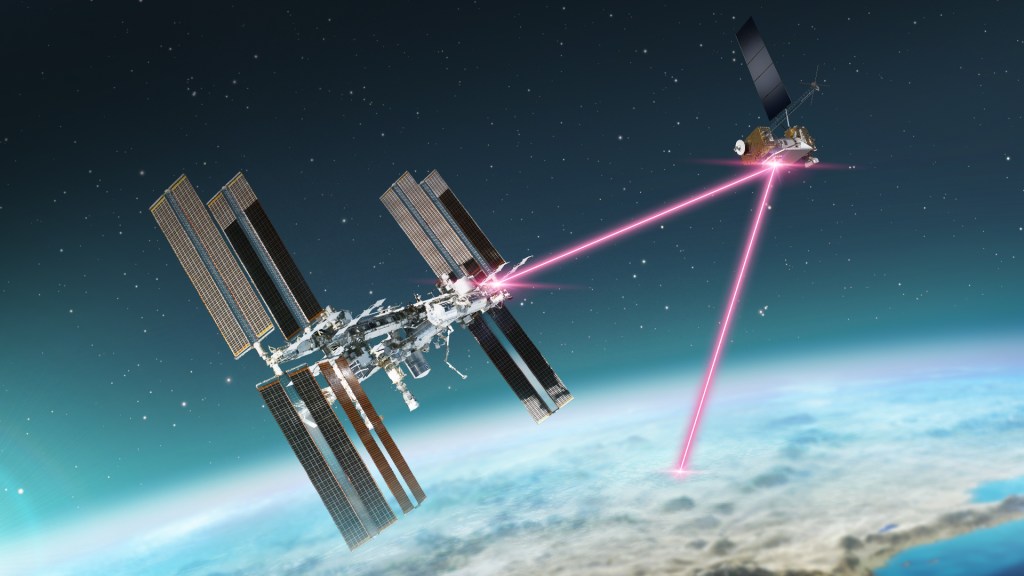

I’m sure many of you are wondering about the title of my remarks because the answer to the question of “Who Won?” seems pretty clear. In the last 3 years, SpaceX has launched 8 commercial human missions to space, including 6 for NASA, the Inspiration4 free-flying mission, and the Ax-1 Private Astronaut Mission. Soon, Blue Origin and Virgin Galactic will have accomplished over a dozen human suborbital flights. In addition, there are currently 4 companies designing and developing commercial LEO space stations.

So, in many ways, the answer to my question is clear. But, at the risk of being a buzzkill, I do have some concerns about where we are headed.

But, before I go there, I’d like to start off with some overall observations about our industry and how we got to this place in time. I’ve been reflecting on this since the Human Landing System award to SpaceX which put an exclamation point on some of the trends that have been occurring in our industry.

20 years ago, there was no commercial human spaceflight industry. And, other than commercial satcom, there wasn’t even really a commercial space industry.

The industry was dominated by large aerospace and defense companies, the so-called traditional aerospace industry. These companies were almost exclusively focused on the federal government as its customer. They didn’t make significant investments in new capabilities, other than some small IRAD investments, and those investments were designed to make the companies more competitive in winning government contracts.

Those were, and are, good businesses run by smart people. I worked for one of those companies for almost a decade and I loved it.

The problem was that the industry was insulated from disruption by start-ups that we see in almost every other industry, like the information technology industry where you can literally start a business in your garage.

Space start-ups, on the other hand, generally need a large and well-educated work force with large facilities, lots of property, and access to big things like test stands and clean rooms. All this is very expensive. So, while there have always been space start-ups, they tended to flame out early because they could not raise the capital required to scale and to compete with the established companies in the industry.

Without that disruption, there was no incentive for the traditional space companies to change. And their focus on the federal government as their main customer ensured that space systems remained expensive because the federal government prioritizes performance over costs. When things are expensive, it limits business opportunities.

There wasn’t a ton of innovation either because government customers don’t like risk, and innovation means changing things, which can come with some additional initial risk.

But then, starting about 20 years ago, we had a relatively brief, wonderful period where the Newspace industry emerged:

1999 – Virgin Galactic was established

2000 – Blue Origin was established

2000 – Paul Allen and Burt Rutan partnered up to design SpaceShipOne

2002 – SpaceX was established

2004 – the Ansari X-Prize was won, and Virgin announced its partnership with Scaled Composites

2006 – the Commercial Spaceflight Federation was founded

There were others during this period, of course, but you get the picture. In this 6-year window, we saw these unique start-ups emerge. They were unique because they were mostly self-financed by wealthy entrepreneurs, so they could blow through the funding barrier that had stopped so many of their predecessors. And they were run by successful businesspeople, not engineers, who brought their extensive business skills to bear on commercial human spaceflight. And, most importantly, they were looking for business opportunities. They were not focused on the federal government as their main customer. So, they needed to innovate and to be cost-effective to attract those business opportunities. That’s the difference between traditional space companies and Newspace companies – it’s their business models. One is not better than the other, they’re just different.

Then, over the next 15 years or so, we had what I call the Commercial Spaceflight Revolution. It was a hard-fought battle that resulted in an almost wholesale disruption of our industry, which brings us to where we are today where the dust has pretty much settled, the revolution is mostly over, and we have a new and larger landscape for our industry.

And I will acknowledge that the results seem to be clear. There are over 80 members of the Commercial Spaceflight Federation. New start-ups are being created all the time with an infusion of capital, and commercial human spaceflight missions are occurring with regularity.

This is all great for those of us who want to see an expansion in human spaceflight, whether it be commercial or otherwise.

So why would I pose the question of “Who won?” It’s because most of the companies I cited earlier have pivoted towards the federal government as the focus of their efforts. I don’t have exact figures, but I am sure that most of SpaceX’s revenue comes from the federal government. After years of shunning the federal government, Blue Origin has embraced NASA and the opportunities associated with our Lunar and LEO activities. The suborbital transportation providers are starting to focus on government sales through the NASA Flight Opportunities Program and the NASA Suborbital Crew Program.

This is not necessarily a bad thing. It’s actually a very good thing for NASA because we get more competition. The problem is that the fundamental DNA of the government hasn’t really changed. There is still a strong preference for performance over cost. Not many of my NASA colleagues ask the question “Is this existing space capability good enough?” and instead they want to specify exactly what they want with a large list of performance requirements which makes things very expensive and ensures that only the federal government can afford the service.

So as the companies in the commercial human spaceflight industry pivot more and more towards the federal government, I worry that they may lose their focus on cost effectiveness which was the spark that led to the revolution in the first place. If that happens, we will have just traded one set of companies for another. That’s what I worry about.

To keep that from happening, all of us in the commercial human spaceflight community must keep obsessively focused on cost effectiveness and business opportunities. That’s what will expand our industry. Otherwise, the industry will always be limited by the size of government space budgets.

The Commercial LEO Destinations program is a perfect example of this. I think this program represents the most significant commercial space opportunity for the next decade, and it will be very telling to see how this program evolves and matures.

So, while the revolution may be over, there’s still lots more work to do. We have Starship coming, promising to further reduce transportation costs. We need a Starship competitor, maybe two. We need a cost-effective space suit, we need a cost-effective docking adapter, we need a quick and easy way to get stuff back down to Earth, and we need a better toilet! The things represent business opportunities, and they’re just waiting for a disrupter to come and disrupt the heck of them.

So, my advice to my colleagues in the private sector is this: Don’t look to the federal government to close your business case. Focus on cost effectiveness and business opportunities, even as the siren song of the government gets louder.

For those of you in the government sector, the major trend has obviously been the transition away from cost-plus contracting. Before Commercial Cargo, fixed-price development was never even considered by NASA for human spaceflight systems. Now, almost every major NASA human spaceflight contract since SLS and Orion has been fixed-price. This is a very significant development because cost-plus contacts either reduce or eliminate the all the features that are important for a successful commercial service.

What I worry about here is that my colleagues in the government will assume that fixed-price contracting will magically fix all the performance issues and cost overruns that we have seen in some cost-plus contracts. But, managing fixed-price contracts can be very difficult unless you focus on these four things:

- Your requirements must be mature and stable. If you constantly change your requirements, then you might as well just have a cost-plus contract because you will have pay for every change.

- The required technology must be well understood so that the private sector can estimate its costs with a relatively high degree of precision, otherwise they won’t enter into a fixed-price contract.

- NASA oversight must be kept to a minimum so that companies are allowed to innovate and be cost-effective. Without this, industry’s incentive for fixed-price contracting evaporates.

- Whenever possible, pick multiple companies. Without competition, if an issue pops up that costs money, then it’s going to lead to a contentious battle which will stretch out the schedule.

If we do these things – if the private sector continues to focus on cost effectiveness and the government sector is careful with fixed-price contracting, then that will conclusively answer the question that I posed about who won.

Thank you.

Phil McAlister