For Mercy Corps, responding to flooding and mudslides in Haiti requires more than shovels; the organization uses NASA Earth observations to safeguard livelihoods after a disaster.

When James Kurz arrived in the Gonaïves area of Haiti, the storm clouds had finally cleared following four successive tropical storms the prior fall. The storms had struck a series of blows within a single month. A nearby school, along with much of the infrastructure around Gonaïves, was buried in mud. Kurz and other volunteers picked up shovels and started digging.

“During some of my early days in Haiti, I made friends with a man named Godson,” Kurz recounted. “He had at one time been preparing to go to law school. His mother had a wholesale food business. They had been middle income and generally were doing quite well. But when Hurricane Jeanne hit, flooding and mudslides destroyed his mother’s facility and inventory. His family went bankrupt, and it completely changed the trajectory of their lives.”

Godson’s story—and the many others like it in Haiti—inspired Kurz to get involved in the emerging microinsurance sector, which is working to provide insurance to low-income entrepreneurs. Insurance is offered for people’s homes, storefronts and merchandise, with payouts ranging from $10 to $125.

Today, Kurz works for Mercy Corps, an international nongovernmental organization that seeks innovative solutions to improve resilience in the face of natural disasters. For Mercy Corps, microinsurance changes the paradigm for disaster response. Rather than simply directing donations into a region after a disaster hits—which can take weeks and results in varying levels of relief—Mercy Corps and its partners saw the potential to adopt the more sustainable approach used in developed markets: insurance. They sought a model that could generate guaranteed payments of a defined amount within days.

“There is the potential for small businesses to advance developing economies and lift people out of poverty,” Kurz said. “For that to work, we need to support and protect the entrepreneurs who are creating those businesses.”

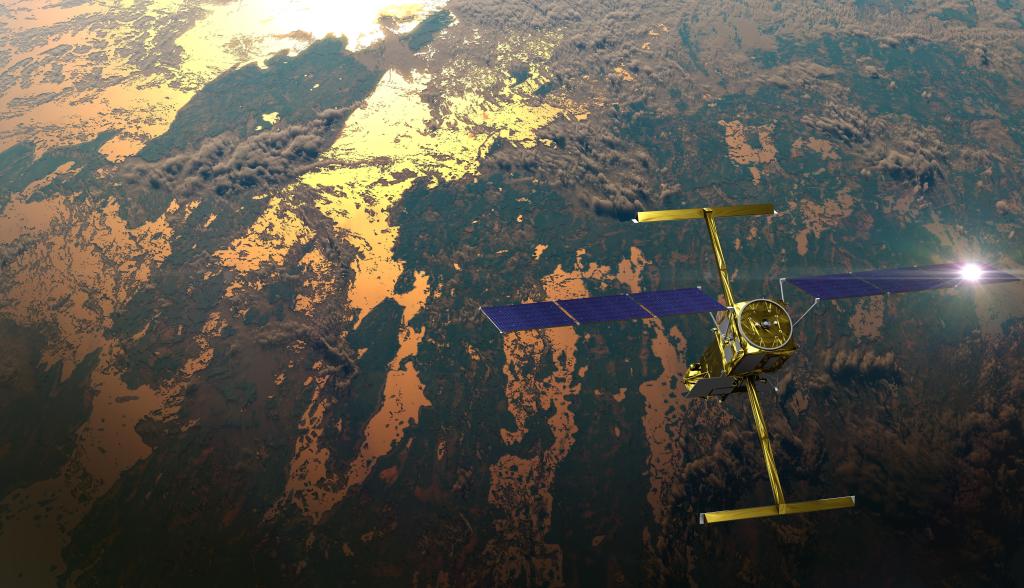

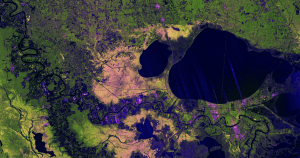

Using satellites for rapid responses

Mercy Corps co-founded the for-profit Microinsurance Catastrophe Risk Organisation (MiCRO) with Haiti’s largest microfinance institution, Fonkoze, and other supporters. MiCRO uses data from NASA to determine historical levels of natural disasters and develop the actuarial tables needed for the insurance product, and also to observe the probability that a disaster has occurred in order to automatically generate payouts.

“Whereas a U.S. insurance agent often takes weeks or more to review or inspect a loss before calculating and processing payment, in rural areas of the tropics we needed something fast and automated,” Kurz said.

MiCRO’s modeling indicated that 200 mm (7.87 inches) or more of precipitation within three days in Haiti was likely to trigger severe consequences, such as flooding and mudslides. Using NASA data, MiCRO was able to determine where this precipitation was likely to have occurred and then automatically generate insurance payments to people in the effected area. Additional funding was available if the actual losses were greater than the modeling predicted.

“If only Godson’s mother could have been insured by MiCRO,” Kurz said.

From 2010 to 2012, MiCRO paid out $8.8 million in insurance benefits to 38,000 entrepreneurs in Haiti—providing lifelines to countless families and communities in the wake of disaster.

With satellite missions such as Global Precipitation Measurement, NASA provides observations of rain and snow worldwide every three hours. The resulting data helps advance our understanding of Earth’s water and energy cycles, improves the forecasting of extreme events that cause natural disasters, and extends the ability to use satellite precipitation information to directly benefit society.

A tropical paradise rebuilds

South of the Gonaïves area, the coastal city of Les Cayes, with its aquamarine waters and palm-clotted coasts, is regarded by many as a tropical paradise.

Josette Lazarre lives near Les Cayes. One of the casualties in Haiti’s devastating earthquake in 2010 was Lazarre’s husband, and she became the sole provider for their three children. To meet her family’s needs, she opened a shop. Through Fonkoze, Lazarre received a microcredit loan to stock her business as well as microinsurance to protect her inventory against future disasters.

The next year, in 2011, heavy rains pummeled southern Haiti. Thirteen people died in the flooding. Aid organizations reported serving 2,000 injured and displaced people. Lazarre lost three-quarters of her inventory—a loss that would normally have threatened her family’s livelihood. But this time, Lazarre had insurance; she (and thousands of insurees like her) received an automatic payment of $125 to help her family meet their immediate needs and to get her business back on track.

“Now that [my husband] is gone, Fonkoze and MiCRO have become my security and protector. I feel at peace knowing that,” Lazarre said at the time.

“Even attempting an initiative like this would be impossible without the Earth observation data that NASA provides,” Kurz explained. “The investment of the American people in Earth observations is helping to give a leg up in places where a little help can go a long way.”

Evolving the model

Ultimately, MiCRO’s first product paid out too much money to be sustainable in the long term in Haiti. “It’s an industry that is learning, adapting and innovating—that’s how advances are made,” Kurz said. Mercy Corps is now improving its model and is poised to launch a revised product in Guatemala later this year. Its approach in Guatemala will make insurance clients eligible for payouts not only on the direct impacts of a disaster on their business but also on the indirect effects. For example, if an earthquake takes out the bridge in a client’s town and cuts off the supply chain, the business can be eligible for a payout if the magnitude of the earthquake qualifies.

“What we learned in Haiti is helping us improve,” Kurz explained. “In Guatemala, we’re introducing major improvements and new processes of testing, meaning the product will be in a stronger position financially.”

If the new model proves sustainable in Guatemala, Mercy Corps sees the potential to scale up the approach considerably to benefit people across Latin America and, ultimately, around the world—including in Haiti.

Microinsurance is an evolving sector, and many organizations—like Mercy Corps—are testing, adapting and improving insurance models that can rapidly respond when disaster strikes. But one thing that all these organizations have in common is a reliance on Earth observation data.

Related Link